OpenAI’s latest innovation, the text-to-video model Sora, has reignited discussions in China about the country’s position in the global artificial intelligence (AI) landscape. This comes after the 2022 unveiling of ChatGPT prompted a wave of introspection among Chinese researchers and investors about their standing in AI development. Historically, China aspired to lead in AI, capitalizing on its extensive data resources to advance in areas such as facial recognition. However, the rise of generative AI, which creates new content from existing models, has positioned China as trailing behind global leaders in this technology frontier.

Launched on February 16, Sora represents a significant leap into video generation AI, challenging China at a time when it faces obstacles such as restricted access to advanced graphics processing units (GPUs) from Nvidia, a leading AI chip manufacturer. This is partly due to heightened U.S. export controls. Experts suggest that China’s stringent internet governance may also hinder its progress in generative AI, a field where flexibility and open innovation are crucial.

Zhou Hongyi, founder of 360 Security Technology, reflected on Sora’s introduction as a wake-up call for China, underscoring the need to acknowledge the gap with global AI leaders. In response, Beijing has mobilized state-owned enterprises to spearhead AI advancements, with the State Council’s State-owned Assets Supervision and Administration Commission urging key firms to adapt to AI-driven changes. Although specific companies have been chosen to champion this cause, their identities remain undisclosed.

The situation highlights the importance of talent, data, and computational power in AI development. Xie Saining, from New York University’s Courant Institute of Mathematical Sciences, stressed these factors and raised concerns about ensuring that such technology is not misused for profit or manipulation.

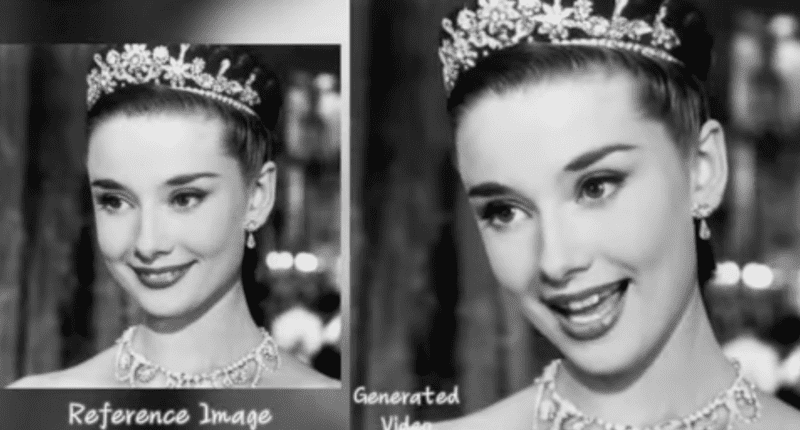

Access to Sora is currently limited, with OpenAI not making it open source or widely available, particularly not in mainland China or Hong Kong due to regulatory requirements. This has left a gap that Chinese tech giants like Baidu, Tencent, and Alibaba are eager to fill, despite not yet matching Sora’s capabilities, particularly its novel Diffusion Transformer architecture.

ByteDance, the parent company of TikTok, admitted that its video motion control tool Boximator is still in development and not ready for widespread use. Meanwhile, there’s a growing interest among Chinese firms in accessing OpenAI’s model once it becomes available on Microsoft Azure’s cloud platform.

As global tech leaders release comparable models, such as Stability AI’s text-to-image model Stable Diffusion 3, the race to decode and replicate Sora’s success intensifies. Some Chinese developers believe that understanding Sora and adapting it with local data could lead to similar products emerging from China.

AI experts in China, like Xu Liang from Hangzhou and Wang Shuyi from Tianjin Normal University, predict the rapid development of Sora-like models in China, leveraging the experience gained from developing large language models (LLMs). They emphasize the potential for localized video models that resonate more with Chinese culture and traditions.

Despite these ambitions, China’s AI sector faces challenges from U.S.-China trade tensions, restricted access to advanced technology, and a potential talent drain. The disparity in market value between China’s top tech firms and their U.S. counterparts has grown, compounded by a perceived lack of quality data and the necessary hardware for training advanced AI models.

The journey towards generative AI excellence in China is fraught with obstacles, from geopolitical tensions to technological limitations. Yet, the drive to innovate and compete on the global stage remains undiminished, with the Chinese AI community keen on narrowing the gap and achieving breakthroughs that could redefine the landscape of AI technology.