Global equity markets held steady on Wednesday after a strong four-day rally that lifted major indices across the U.S., Europe, and Asia. Investors, having driven markets upward on optimism about cooling inflation, resilient corporate earnings, and expectations of policy easing from central banks, paused to reassess valuations and incoming economic data.

The calm trading session reflects a market in transition: no longer gripped by fear, but not yet comfortably bullish. The past week’s gains were fueled by optimism, but the next phase of the rally will depend on whether economic fundamentals support continued momentum.

Markets are now at a crucial inflection point—buoyant enough to avoid a pullback, yet cautious enough to prevent overextension. The question investors face is whether this pause marks consolidation before another leg upward, or the beginning of a broader cooling in global risk appetite.

A Four-Day Rally Driven by Hope—and Data

The recent upswing in global equities has been unusually broad-based, spanning:

- U.S. megacaps and tech stocks,

- European blue chips,

- Asian exporters,

- emerging market indices, and

- global cyclical sectors tied to growth.

Key drivers behind the surge:

1. Inflation indicators continue to cool

Recent CPI and PPI readings across major economies have shown progress toward central bank targets, reinforcing the view that rate cuts are nearing.

2. Corporate earnings have surprised to the upside

Despite forecasts of recession or slowdown, many companies—from tech giants to industrial firms—have delivered better-than-expected profit results.

3. Strong consumer resilience

U.S. consumer spending, Chinese retail data, and European services activity show pockets of strength that challenge the gloomy forecasts of earlier this year.

4. Growing belief in a “soft landing”

Investors are increasingly betting on a scenario where inflation falls without triggering a deep recession—once considered implausible.

This combination of macro optimism and corporate resilience produced the four-day rally. But markets rarely climb in a straight line, and Wednesday’s stabilization reflects a natural cooling after strong gains.

U.S. Markets: A Pause After Tech-Led Gains

U.S. stocks were mostly flat, with the S&P 500, Nasdaq, and Dow Jones Industrial Average all hovering near recent highs, but without significant moves during the session.

Key themes in U.S. trading:

- Megacap tech stocks slowed after leading the rally, as investors digested valuation concerns.

- Treasury yields held relatively stable, reducing volatility in rate-sensitive sectors.

- Earnings announcements in retail and manufacturing influenced sector-specific moves.

- The dollar softened slightly, helping exporters and commodity-linked companies.

Traders say the market is shifting from “momentum buying” to “wait-and-see mode” ahead of upcoming economic releases.

Europe: Cautious Optimism Amid Policy Uncertainty

European markets also steadied after a week of gains, with the Stoxx 600, DAX, FTSE 100, and CAC 40 all showing marginal changes.

Factors shaping European sentiment:

- ECB policy expectations remain uncertain, with investors split on how soon rate cuts might begin.

- Eurozone inflation is improving, though wage pressures persist.

- Energy markets are calmer, reducing volatility for energy-intensive industries.

- Corporate earnings remain mixed, offering less clarity than in the U.S.

Europe’s consolidation reflects modest confidence but significant caution, particularly around the economic outlook for Germany and Southern Europe.

Asia: Stability After Strong Gains in Tech and Export Sectors

Asian markets also cooled after a multi-session rally as investors processed:

- improved export data from South Korea and Japan,

- better-than-expected earnings from Asian semiconductor firms,

- policy support signals from China, and

- yen and yuan stability after months of volatility.

China’s markets, which had been under pressure earlier this year, have shown signs of stabilization due to targeted stimulus measures for housing, infrastructure, and consumer spending.

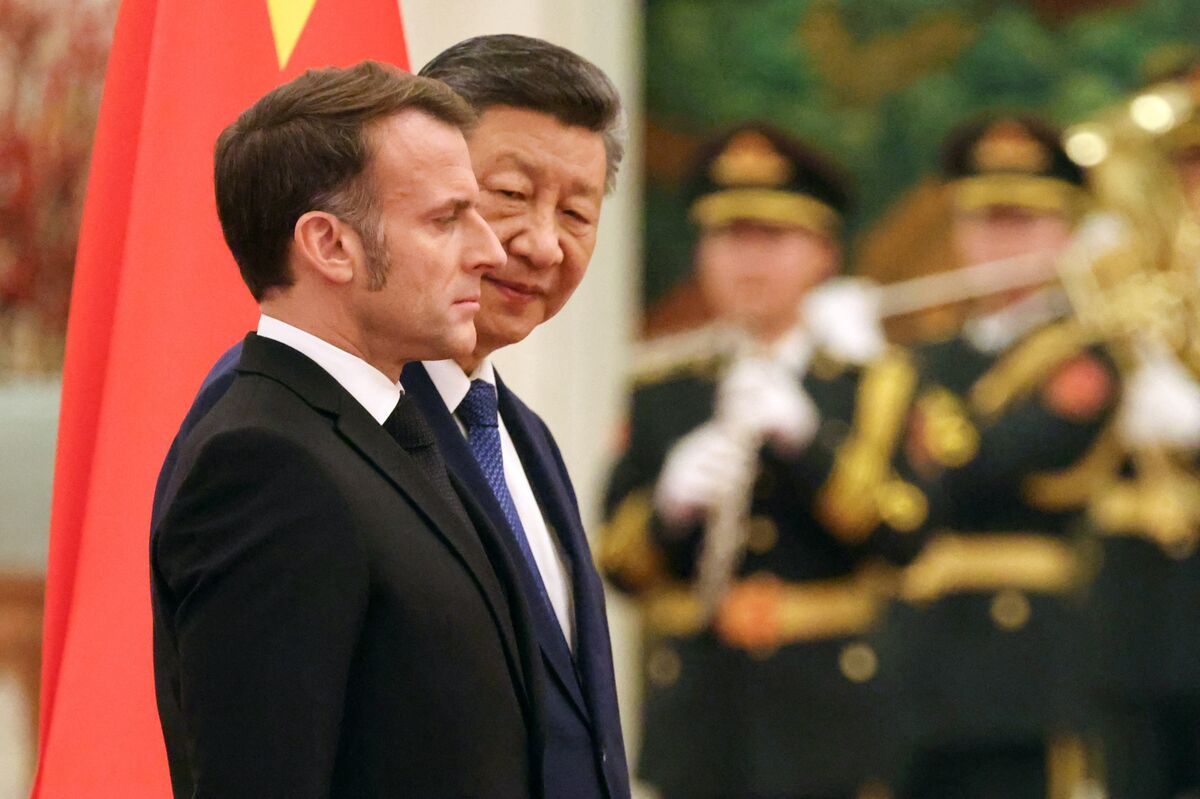

Asian investors appear cautiously optimistic, but geopolitical tensions—from the South China Sea to U.S.-China tech decoupling—remain a background risk.

Currencies and Commodities: Calm and Consolidation

Dollar: Slightly softer as risk appetite improved.

Euro and Pound: Strengthened marginally on solid economic data.

Oil: Stable after earlier declines tied to demand concerns.

Gold: Held steady as rate expectations remain anchored.

Commodity markets are reflecting the same theme seen in equities: stabilization, not reversal.

What Investors Are Watching Next

The market’s strong rally and subsequent pause have set the stage for an important stretch of economic and policy events that will dictate the next move.

1. Upcoming inflation data

Fresh CPI and PPI releases in the U.S. and Europe will either confirm or challenge the disinflation trend.

2. Central bank meetings

The Federal Reserve, ECB, and Bank of England are approaching pivotal meetings that could determine whether rate cuts occur in the first half of the year.

3. U.S. earnings season

Investors will scrutinize forward guidance from major retailers, banks, tech firms, and industrials.

4. China’s policy direction

Any hints of additional stimulus or structural reforms could support global risk appetite.

5. Geopolitical developments

Conflicts in Ukraine and the Middle East are global wildcards that can shift sentiment rapidly.

Is This a Healthy Pause or a Warning Sign?

Market analysts generally view the stabilization as a constructive sign. After rising for four straight days, equities needed a breather. Consolidation helps prevent “overheated” conditions and gives investors time to assess fundamentals.

However, risks remain:

- valuations in some sectors are stretched,

- economic growth is uneven globally,

- and corporate margins may face pressure if wage costs continue rising.

If upcoming data disappoints, the rally could fade. But if economic indicators support the narrative of a soft landing, markets may resume their upward trajectory.

Conclusion: Investors Catch Their Breath as Markets Shift from Fear to Caution

After a powerful four-day rally, global stocks holding steady is not a sign of weakness—it is a sign of recalibration. The world’s markets are adjusting to a new balance between optimism and realism, with investors mindful that the coming weeks will determine whether the rally gains traction or stalls.

For now, the mood is steady rather than euphoric, measured rather than speculative. The rally may pause, but it has not reversed, and markets appear poised for movement once the next round of data clarifies the path forward.

The world’s investors are watching—and waiting—for the next signal.