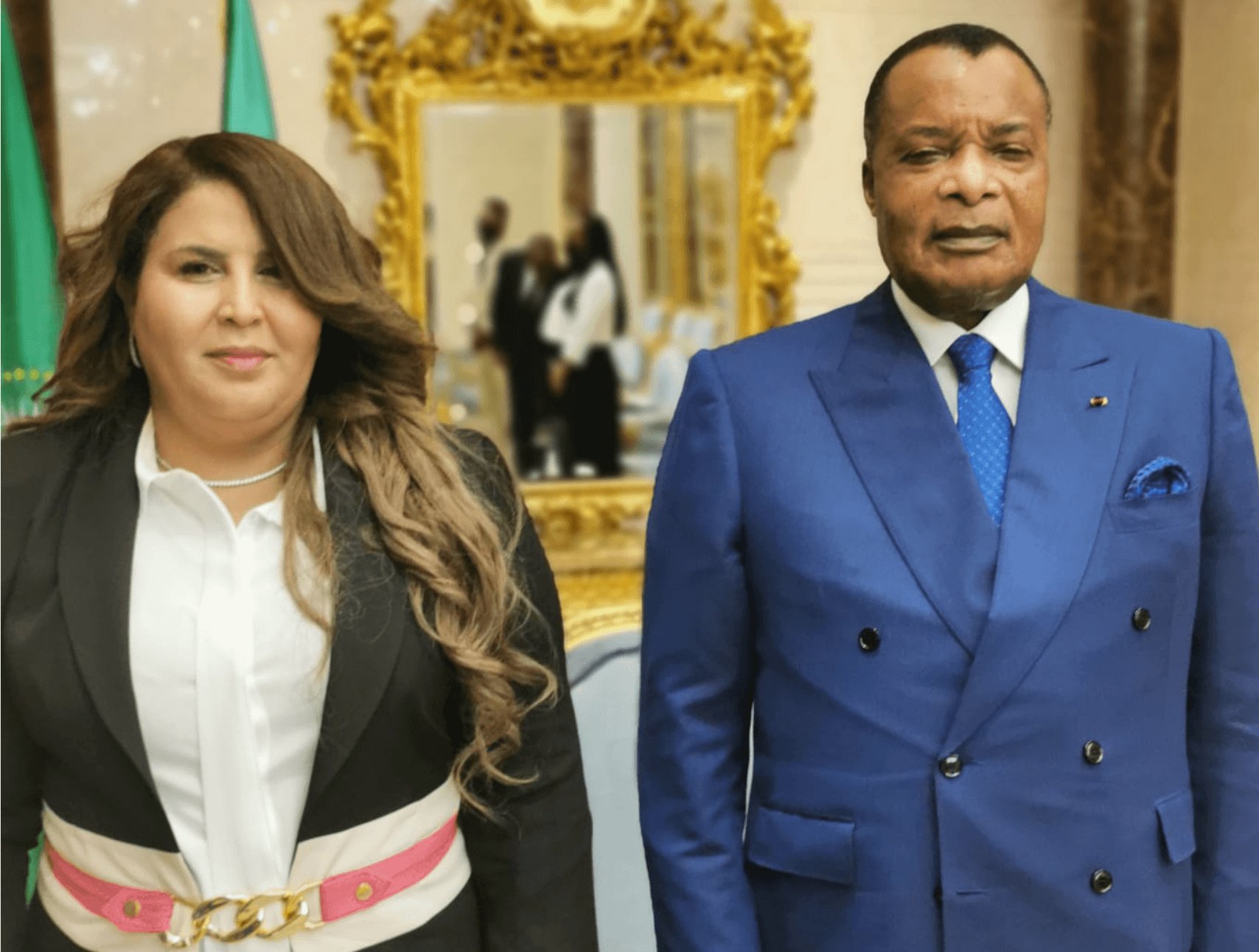

In a recent discourse on the complexities of commodity trading, CEO Hanen Benabdeladhim shared invaluable insights into navigating the volatile markets successfully. With a career that exemplifies strategic foresight and exceptional leadership in the business realm, Benabdeladhim’s approach to commodity trading is both instructive and inspiring for traders at all levels. Here are three key strategies she emphasizes for thriving in the commodity markets.

1. In-depth Market Analysis

Benabdeladhim underscores the importance of rigorous market analysis as the foundation of successful commodity trading. Understanding the multifaceted factors that influence commodity prices, including geopolitical events, supply and demand dynamics, and seasonal patterns, is crucial. She advocates for a comprehensive approach that combines historical data analysis with an awareness of current global events to anticipate market movements accurately. For traders looking to emulate her success, investing time and resources in gaining a deep understanding of the markets is indispensable. This involves staying updated with global news, engaging in continuous learning, and employing analytical tools to make informed decisions.

2. Risk Management Strategies

The volatile nature of commodity markets demands robust risk management strategies, a principle Benabdeladhim staunchly supports. She emphasizes the necessity of setting clear risk parameters and employing tactics such as stop-loss orders to protect investments. Diversification is another strategy she champions, advising traders to spread their investments across various commodities to mitigate risks associated with market fluctuations. Benabdeladhim’s approach to risk management is about balancing ambition with prudence, ensuring that traders can pursue opportunities without exposing themselves to undue risk.

3. Long-term Perspective

While commodity trading can offer significant short-term gains, Benabdeladhim advises traders to adopt a long-term perspective. She believes that patience and consistency are key to realizing substantial returns. This long-term approach involves looking beyond temporary market volatilities and focusing on the underlying value and potential of commodities. Benabdeladhim encourages traders to be resilient, not swayed by short-term market sentiments, and to stay committed to their trading strategies over time.

In essence, Hanen Benabdeladhim’s strategies for successful commodity trading—comprehensive market analysis, meticulous risk management, and a long-term perspective—offer a blueprint for navigating the commodity markets effectively. Her insights reflect a deep understanding of the complexities of trading and a commitment to ethical and strategic business practices. For aspiring traders and seasoned professionals alike, Benabdeladhim’s approach is a source of inspiration and guidance in the pursuit of commodity trading success.